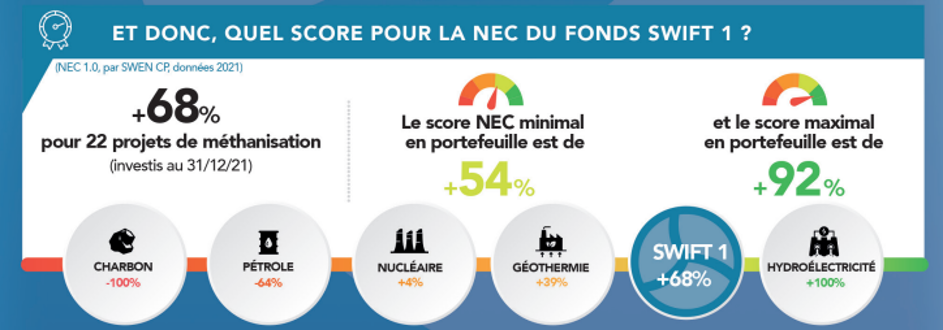

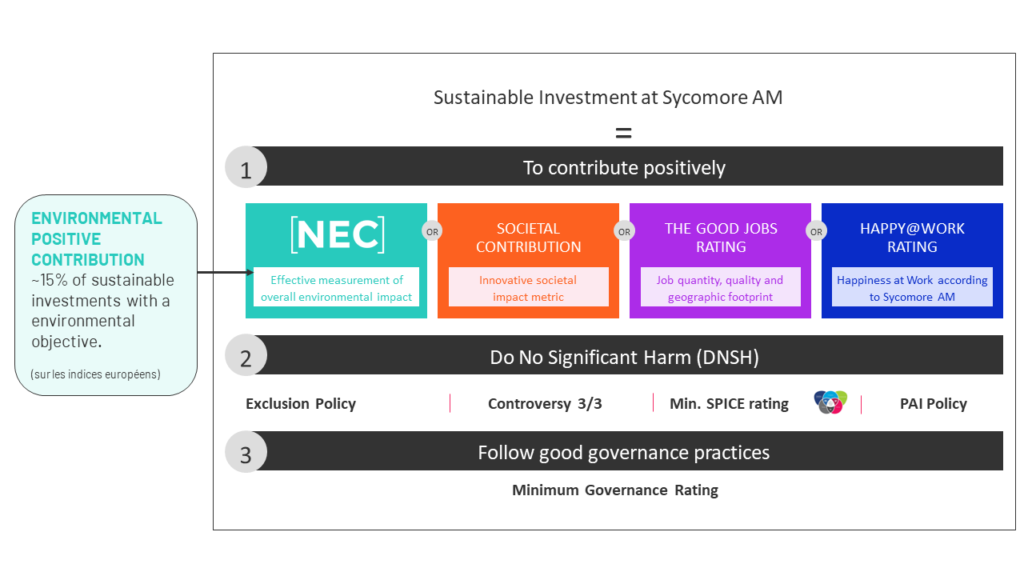

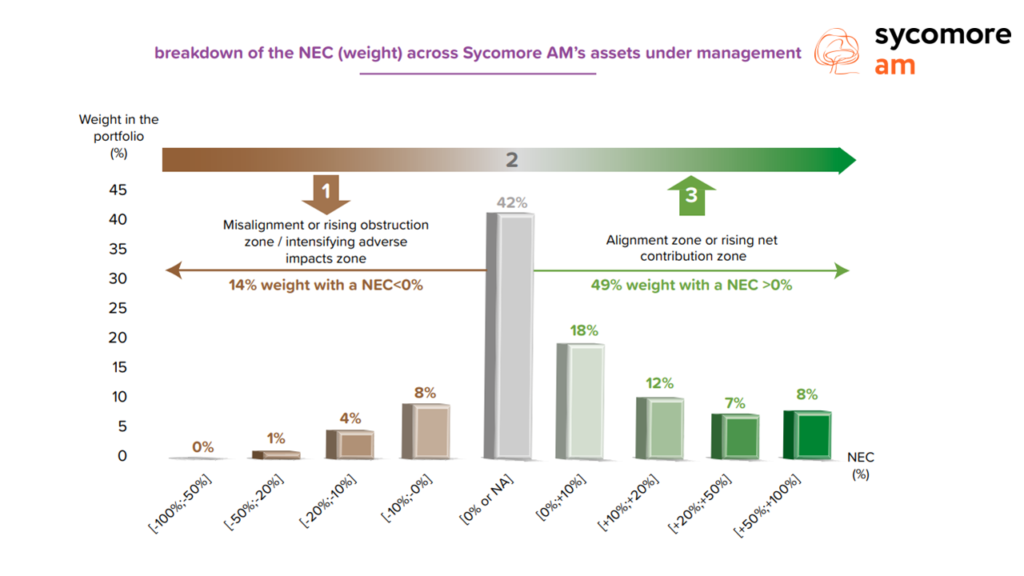

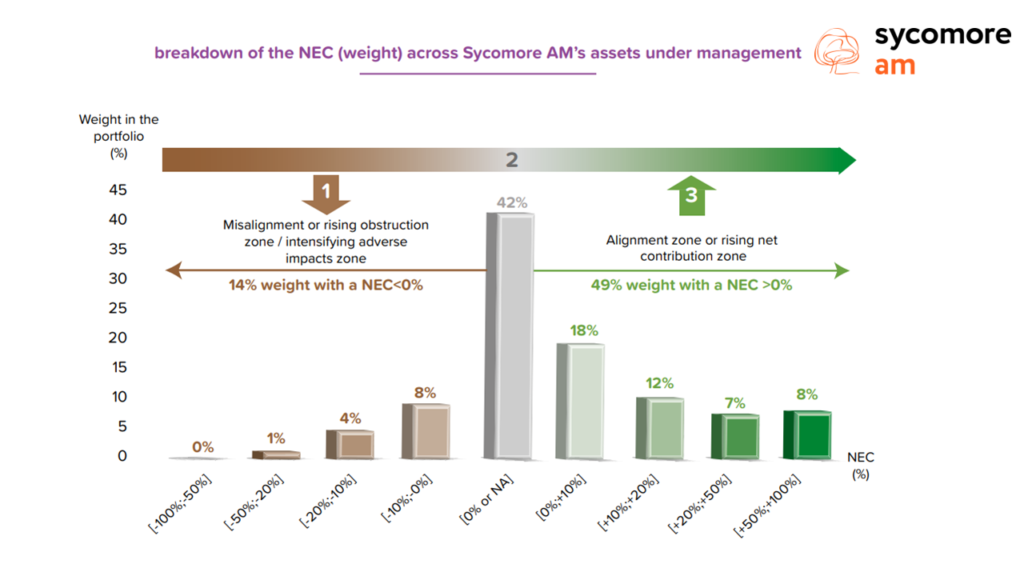

During the pre-investment phase or due diligence, the NEC metric gives investors a clear picture of the total impact of a product, service, company or even an entire sector. It is used to:

- Assist investors in identifying investment opportunities that are aligned with the ecological transition, and that present transition opportunities;

- Identify the business models that are damaging to natural capital and exposed to transition risks;

- Identify less impactful activities, thereby enabling investors to harness growth from transition opportunities.